Chapter 31 Analysis of covariance

Packages for this chapter:

library(MASS)

library(car)

library(tidyverse)31.1 Productivity and research-and-development

An economist compiled data on productivity improvements for a sample of companies that produce electronic equipment. The companies were classified according to their expenditures on research and development in the last three years (classified as low, moderate, high). Productivity improvement is measured on a 0–100 scale, with most values being between 0 and 10. The economist also thought that last year’s productivity improvement would be relevant, and so recorded this as well.

The data set can be found at link.

Feel free to use “R&D” as an abbreviation for “research and development” in your answers below.

Read in and display at least some of the data.

Plot productivity improvement for this year against last year, identifying the points by the level of research-and-development expenditure. On your plot, add regression lines for each expenditure group.

* Look at your graph of the previous part. Do you think that (i) knowing last year’s productivity improvement tells you something about this year’s, (ii) the level of expenditure on research-and-development has an impact on this year’s productivity improvement, (iii) there is an interaction effect between R&D expenditure and last year’s productivity increase on this year’s productivity increase? In each case, explain briefly.

Fit an analysis of covariance model without interaction. Run the results through

drop1withtest="F"(theFmust be in quotes). What do you conclude?Now look at the

summaryof your analysis of covariance model. Explain briefly how each of the last three numbers in theEstimatecolumn are consistent with your graph.Add an interaction between

lastandexpenditureto your analysis of covariance model. Test it for significance usingdrop1. In the light of what you have seen, does this surprise you? Explain briefly why you are or are not surprised.

31.2 Treating leprosy

Two drugs are being tested in the treatment of leprosy. These are labelled A and D. There is also a control drug, labelled F. The response variable is a post-treatment score of leprosy bacilli (measured at six different sites on each patient). A lower score is better.

Thus far, we have a standard one-way analysis of variance. But the

researchers wanted greater precision in assessing the effects (if any)

of the drugs, so they also measured a pre-treatment score of leprosy

bacilli. The data are in the file

link. The

pre-treatment and post-treatment scores are labelled pre and

post respectively.

Read in the data and check that you have apparently the right thing.

* Make a scatterplot of post-treatment score against pre-treatment score, with the points for each drug drawn in a different colour.

Does it appear that including the pre-treatment score was a good idea? Explain briefly.

What about this dataset suggests that analysis of covariance is a method worth trying?

Fit an analysis of covariance model to predict post-treatment score. Include an interaction between your explanatory variables. (You don’t need to look at the output from the model.)

Pass your fitted model of the last part into

drop1. Is the interaction term significant?Fit a model without the interaction. Is this a sensible thing to do (in addition, that is, to the fact that I just asked you to do it)?

Take a look at the

summaryof your preferred model. Is there a significant effect of pre-treatment score? Describe the effects of the different drugs on the post-treatment score. (Don’t do any tests fordrug.) Does your comparison of drugs make sense?Obtain predicted values for

postfor each of the three drugs atprescores 5, 12 and 20. To do this, obtain a new data frame that has all 9 combinations of drugs andprescores, and then feed this intopredictusing your preferred model.36Now, plot the data with the fitted lines on.

Are the lines on your plot parallel, with the same slopes? Is this what you would expect? Explain briefly.

My solutions follow:

31.3 Productivity and research-and-development

An economist compiled data on productivity improvements for a sample of companies that produce electronic equipment. The companies were classified according to their expenditures on research and development in the last three years (classified as low, moderate, high). Productivity improvement is measured on a 0–100 scale, with most values being between 0 and 10. The economist also thought that last year’s productivity improvement would be relevant, and so recorded this as well.

The data set can be found at link.

Feel free to use “R&D” as an abbreviation for “research and development” in your answers below.

- Read in and display at least some of the data.

Solution

The data values are separated by one space, so let’s use

read_delim and display whatever displays (probably the

first ten lines):

my_url <- "http://ritsokiguess.site/datafiles/productivity.txt"

productivity <- read_delim(my_url, " ")## Rows: 27 Columns: 3

## ── Column specification ────────────────────────────────────────────────────────

## Delimiter: " "

## chr (1): expenditure

## dbl (2): improvement, last

##

## ℹ Use `spec()` to retrieve the full column specification for this data.

## ℹ Specify the column types or set `show_col_types = FALSE` to quiet this message.productivity## # A tibble: 27 × 3

## expenditure improvement last

## <chr> <dbl> <dbl>

## 1 low 7.6 8.2

## 2 low 8.2 7.9

## 3 low 6.8 7

## 4 low 5.8 5.7

## 5 low 6.9 7.2

## 6 low 6.6 7

## 7 low 6.3 6.5

## 8 low 7.7 7.9

## 9 low 6 6.3

## 10 moderate 6.7 8.8

## # … with 17 more rowsThere is a column classifying expenditure along with numerical values

for productivity improvement for this year and last year (labelled

improvement and last), so it looks as if we are

good.

You are free to give the data frame a shorter name to make it easier to keep typing it!

Extra: those expenditure levels (that are currently text) will get sorted into alphabetical order unless we stop them. They are actually in the right order in the data file, so maybe we should turn them into a factor (with the levels in the right order) now:

productivity %>%

mutate(expenditure = fct_inorder(expenditure)) -> productivityIf you don’t do this, your answers below will be different from mine. Probably not in any kind of consequential way, but different nonetheless.

\(\blacksquare\)

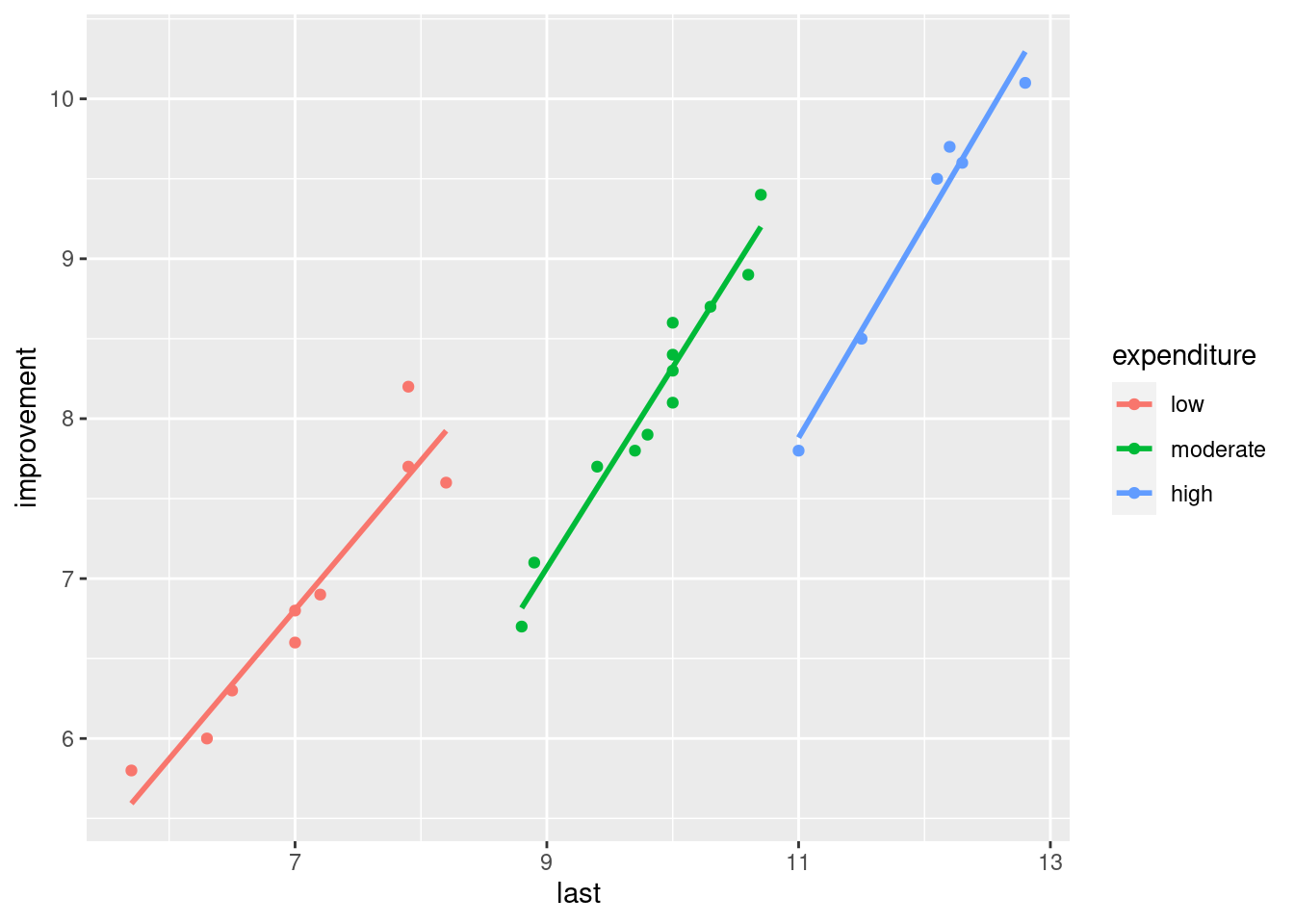

- Plot productivity improvement for this year against last year, identifying the points by the level of research-and-development expenditure. On your plot, add regression lines for each expenditure group.

Solution

Two quantitative and one categorical variable, so plot the

categorical variable using colour (or shape etc., if you

know about that, but colour is the most obvious thing):

ggplot(productivity, aes(x = last, y = improvement, colour = expenditure)) +

geom_point() + geom_smooth(method = "lm", se = F)## `geom_smooth()` using formula 'y ~ x'

The se=F is optional; no problem if you don’t include it. (If

you miss it out, you’ll get those CI-of-mean-response grey envelopes

around each line.)

\(\blacksquare\)

- * Look at your graph of the previous part. Do you think that (i) knowing last year’s productivity improvement tells you something about this year’s, (ii) the level of expenditure on research-and-development has an impact on this year’s productivity improvement, (iii) there is an interaction effect between R&D expenditure and last year’s productivity increase on this year’s productivity increase? In each case, explain briefly.

Solution

Taking the three things in turn: (i) knowing about last year’s productivity increase definitely helps, because the three trends definitely go up (extra: and are pretty much linear). (ii) knowing about the level of expenditure helps because the coloured trends are in different places (low on the left and high on the right, whatever colours they are for you). (iii) I am guessing there is no interaction because the three lines look more or less parallel (a judgement call: if you think that there will be an interaction because you think the lines are definitely not “approximately parallel” and therefore there is an interaction, that’s OK too).

\(\blacksquare\)

- Fit an analysis of covariance model without interaction. Run

the results through

drop1withtest="F"(theFmust be in quotes). What do you conclude?

Solution

This looks exactly like a regression with a categorical variable, and is. Just the two main effects, thus:

improvement.1 <- lm(improvement ~ last + expenditure, data = productivity)

drop1(improvement.1, test = "F")## Single term deletions

##

## Model:

## improvement ~ last + expenditure

## Df Sum of Sq RSS AIC F value Pr(>F)

## <none> 1.3175 -73.542

## last 1 14.0447 15.3622 -9.226 245.176 9.274e-14 ***

## expenditure 2 4.1958 5.5134 -38.894 36.623 7.095e-08 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1Both the P-values are small, so there is strong evidence of an effect on this year’s productivity increase of last year’s productivity increase and the level of R&D expenditure.

\(\blacksquare\)

- Now look at the

summaryof your analysis of covariance model. Explain briefly how each of the last three numbers in theEstimatecolumn are consistent with your graph.

Solution

To begin:

summary(improvement.1)##

## Call:

## lm(formula = improvement ~ last + expenditure, data = productivity)

##

## Residuals:

## Min 1Q Median 3Q Max

## -0.52812 -0.16385 -0.00046 0.08379 0.45730

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) -1.00804 0.50991 -1.977 0.0602 .

## last 1.11417 0.07116 15.658 9.27e-14 ***

## expendituremoderate -1.83316 0.22372 -8.194 2.84e-08 ***

## expenditurehigh -3.14338 0.37115 -8.469 1.59e-08 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 0.2393 on 23 degrees of freedom

## Multiple R-squared: 0.9629, Adjusted R-squared: 0.958

## F-statistic: 198.8 on 3 and 23 DF, p-value: < 2.2e-16The last three numbers in the Estimate column are slopes for the

quantitative variable last and changes in intercept for the

levels of the categorical variable expenditure. Specifically:

the slope for

lastis positive, so if last year’s productivity increase is higher, this year’s will be higher as well. This matches the upward trends within eachexpendituregroup on the graph.expenditureis categorical, so everything is measured relative to the baseline. Mine islow, but yours is probablyhigh.My two estimates for

expenditurehighandmoderateare both negative, so when expenditure on R&D is high or moderate, the productivity increase will be lower this year (for the same productivity increase last year). Going back to the graph, if you extend the lines formoderateandhighto a middlinglastvalue of something like 10, the productivity increase this year will be higher whenexpenditureis low or moderate then when it is high, which is consistent with those slopes both being positive. (You don’t need to go to this detail, but you should say something convincing from the graph about how this year’s productivity increase is higher if R&D expenditure is low or moderate compared to high.)

Extra: the graph also indicates that the higher the

expenditure on R&D is, the more likely last year’s

productivity improvement will be higher also. So in practice we are

not likely to be comparing actual companies with different

expenditure but the same last. Nonetheless, what I

said is what those positive coefficients for expenditure

actually mean. Be careful not to say that low is lowest

because it’s on the left; it’s whether it’s higher or lower than the

others at the same value of last that matters.

Extra extra: I asked you to do the test from drop1 because

there are three levels of expenditure (rather than just two),

and the summary output only gives you a comparison with the

baseline level, rather than comparing all three

levels. I prefer to do the right test (using drop1) first,

and then use summary to interpret what I have, or at least

the parts of it that are significant.

Extra extra extra: you would (or at least I would) expect a larger productivity increase to go with a larger expenditure on R&D, but that’s not how it worked out. This is one of those cases where all else isn’t really equal.

\(\blacksquare\)

- Add an interaction between

lastandexpenditureto your analysis of covariance model. Test it for significance usingdrop1. In the light of what you have seen, does this surprise you? Explain briefly why you are or are not surprised.

Solution

I like update for this (writing out the whole model is an

alternative):

improvement.2 <- update(improvement.1, . ~ . + last:expenditure)

drop1(improvement.2, test = "F")## Single term deletions

##

## Model:

## improvement ~ last + expenditure + last:expenditure

## Df Sum of Sq RSS AIC F value Pr(>F)

## <none> 0.95718 -78.169

## last:expenditure 2 0.36035 1.31753 -73.542 3.953 0.03491 *

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1Yes, I too forgot the test="F" the first time.

The interaction term is actually significant, at least at \(\alpha=0.05\). This is a surprise to me, because I thought those lines on the graph were pretty close to parallel, so I wasn’t expecting to see a significant interaction. (What I want from you here is to look back at your answer to (iii) in part (here), and to say how this small P-value is consistent or inconsistent with whatever you said there. If you said that the lines weren’t parallel enough, then this significant interaction should not be a surprise to you.)

That’s all I’m after. I don’t need you to speculate on why the test came out significant. I will, in a moment, but you don’t need to.

Extra: I didn’t expect the interaction to come out significant, but the P-value is not nearly so small as the ones we had before. I guess the explanation for this is that the data cluster pretty tightly about the lines in the graph, so that even a small difference in slopes can be signficant. You might argue that my red line is not quite as steep as the others, but the difference does look very small.

Let’s take a look at the summary for my interaction model:

summary(improvement.2)##

## Call:

## lm(formula = improvement ~ last + expenditure + last:expenditure,

## data = productivity)

##

## Residuals:

## Min 1Q Median 3Q Max

## -0.32417 -0.14885 -0.02465 0.13739 0.55556

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 0.27827 0.64967 0.428 0.67278

## last 0.93243 0.09124 10.220 1.32e-09 ***

## expendituremoderate -4.50268 1.25959 -3.575 0.00179 **

## expenditurehigh -7.14795 1.91223 -3.738 0.00121 **

## last:expendituremoderate 0.32217 0.14243 2.262 0.03444 *

## last:expenditurehigh 0.40858 0.17549 2.328 0.02997 *

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 0.2135 on 21 degrees of freedom

## Multiple R-squared: 0.973, Adjusted R-squared: 0.9666

## F-statistic: 151.5 on 5 and 21 DF, p-value: 9.763e-16The last two Estimates, the ones beginning with last:, came

from the interaction. Once again low is my baseline. These

say how the slopes for last for the other groups

differ from the slopes for last for low

expenditure. (Yes, this is confusing. Read it again until you get it.)

The biggest-size difference in slopes, about \(0.40\), is between low expenditure and high expenditure. This says that the line for high expenditure is this much more steep than the line for low expenditure. That’s where the non-parallelism is on the graph, such as it is. A small but significant difference in slopes. You can tell that the effect is small by looking in the Estimate column; those changes in slopes, \(0.40\) and \(0.32\), are the smallest things in size out of everything in that column.

Having seen this, you now realize that I did this question wrong (or, at least, I led you through it wrong). The right way to do this would have been to fit the interaction model first, see that it is significant, and then done some predictions to assess the effects of things:

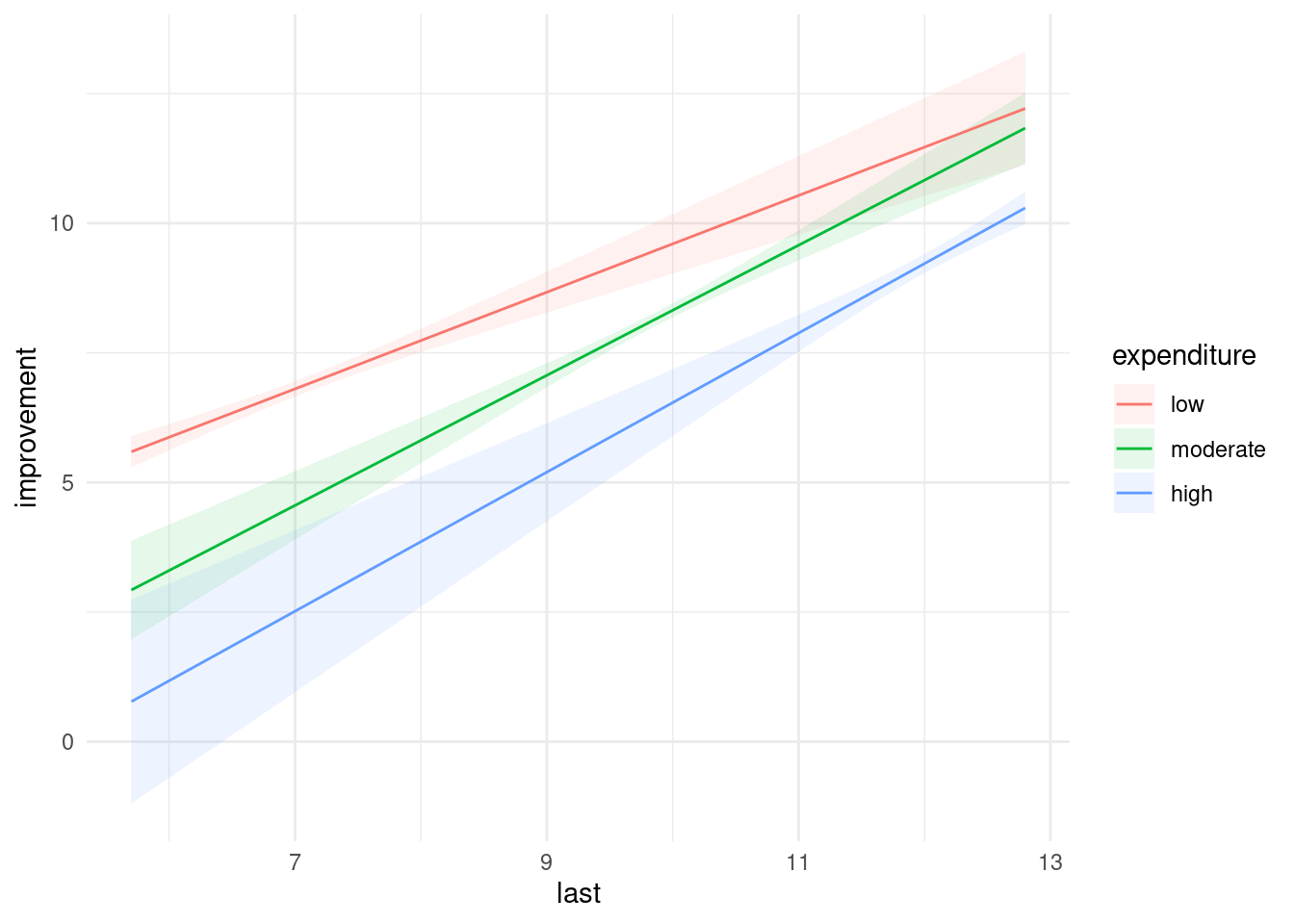

plot_cap(improvement.2, condition = c("last", "expenditure"))

The three lines are not quite parallel, and evidently non-parallel enough to be significant. (This graph does not give you any sense of how much variability there is in the slopes; the at-least partial non-overlapping of the confidence envelopes tells you that there is a significant effect of expenditure, but it doesn’t tell you about the interaction.)

The effect is more or less as we described it before: as last

goes up (for fixed expenditure), the predicted productivity

improvements for this year go up, and as expenditure level

goes up, the predictions go down. But the rates at which they

go up or down are different, which is the significant interaction

coming into play. Having said that, they are not very different, so I

cheated and pretended the interaction was not significant (or that I

was using \(\alpha=0.01\)), so that you would have something easier to

interpret. Qualitatively, the story is the same either way, because

the sizes of the interaction terms are small compared to the

others. So, even though I cheated, you ended up with more or less the

same conclusions doing it the way I asked you to do it, or doing it

the way I just did it.

\(\blacksquare\)

31.4 Treating leprosy

Two drugs are being tested in the treatment of leprosy. These are labelled A and D. There is also a control drug, labelled F. The response variable is a post-treatment score of leprosy bacilli (measured at six different sites on each patient). A lower score is better.

Thus far, we have a standard one-way analysis of variance. But the

researchers wanted greater precision in assessing the effects (if any)

of the drugs, so they also measured a pre-treatment score of leprosy

bacilli. The data are in the file

link. The

pre-treatment and post-treatment scores are labelled pre and

post respectively.

- Read in the data and check that you have apparently the right thing.

Solution

Take a look at the data file. The values have multiple spaces

between them, but they are aligned with each other and the

column headings, so read_table is the thing:

my_url <- "http://ritsokiguess.site/datafiles/leprosy.txt"

lepro <- read_table(my_url)##

## ── Column specification ────────────────────────────────────────────────────────

## cols(

## drug = col_character(),

## pre = col_double(),

## post = col_double()

## )## Warning: 24 parsing failures.

## row col expected actual file

## 1 -- 3 columns 4 columns 'http://ritsokiguess.site/datafiles/leprosy.txt'

## 2 -- 3 columns 4 columns 'http://ritsokiguess.site/datafiles/leprosy.txt'

## 3 -- 3 columns 4 columns 'http://ritsokiguess.site/datafiles/leprosy.txt'

## 4 -- 3 columns 4 columns 'http://ritsokiguess.site/datafiles/leprosy.txt'

## 5 -- 3 columns 4 columns 'http://ritsokiguess.site/datafiles/leprosy.txt'

## ... ... ......... ......... ................................................

## See problems(...) for more details.lepro## # A tibble: 30 × 3

## drug pre post

## <chr> <dbl> <dbl>

## 1 A 11 6

## 2 A 6 4

## 3 D 6 0

## 4 D 8 4

## 5 F 16 13

## 6 F 16 12

## 7 A 8 0

## 8 A 10 13

## 9 D 6 2

## 10 D 19 14

## # … with 20 more rowsCall it what you like.

That looks good, with variables of the right names.

\(\blacksquare\)

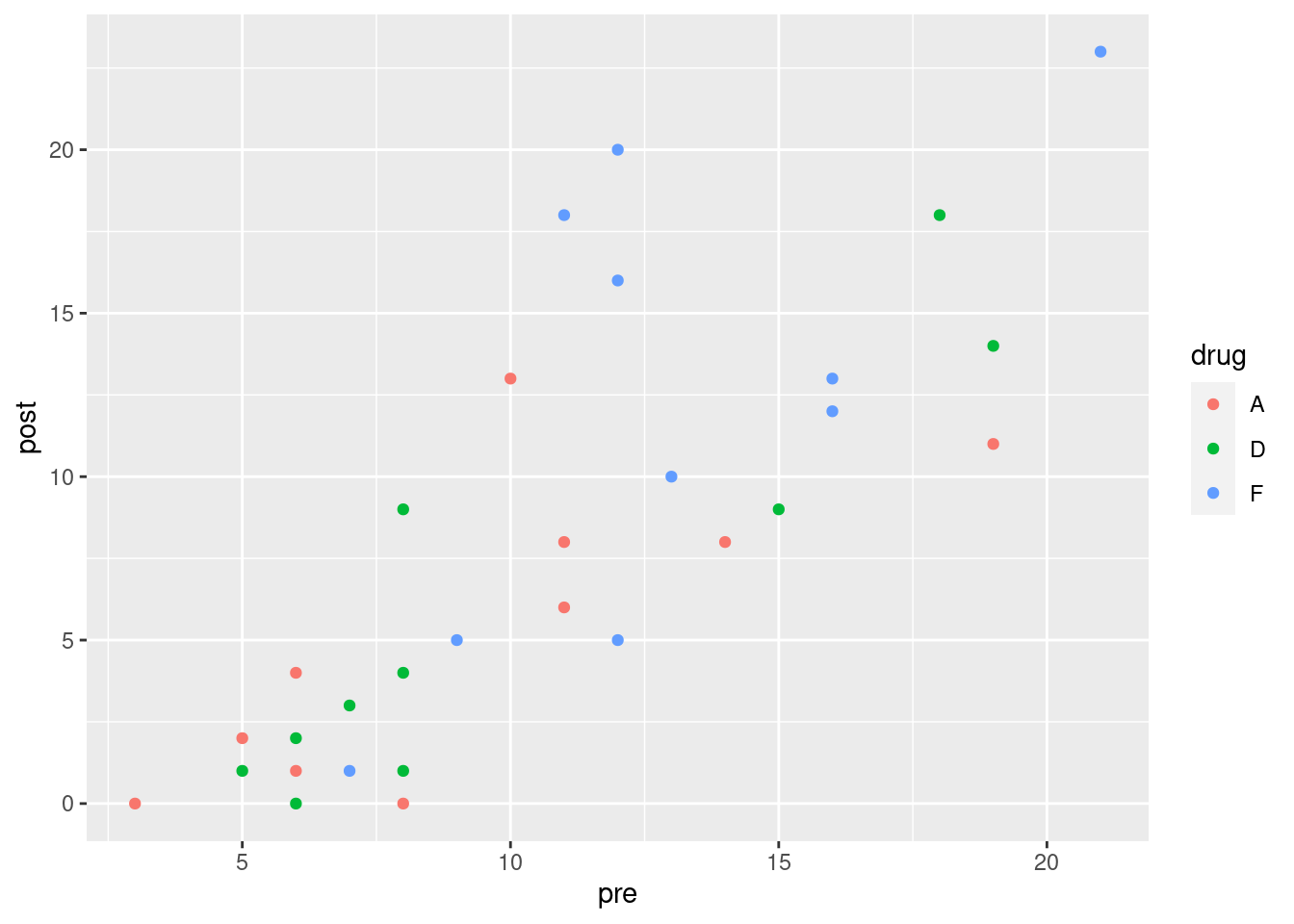

- * Make a scatterplot of post-treatment score against pre-treatment score, with the points for each drug drawn in a different colour.

Solution

This is the kind of thing that ggplot does without

batting an eyelid:

ggplot(lepro, aes(x = pre, y = post, colour = drug)) + geom_point()

\(\blacksquare\)

- Does it appear that including the pre-treatment score was a good idea? Explain briefly.

Solution

The overall trend on the scatterplot is that a higher pre

tends to go with a higher post, regardless of drug, so

including this information appears to be informative.

I personally suspect that there’s some fan-out happening on the

pre-post relationship, but I’m not planning to make you explore that.

\(\blacksquare\)

- What about this dataset suggests that analysis of covariance is a method worth trying?

Solution

The key is a mixture of categorical and quantitative explanatory

variables. Here we have a categorical variable drug and a

quantitative one pre.

If we had only one type of explanatory variable, we could do a

regression or an ANOVA as appropriate. But we don’t. In some ways,

it’s not worth making a fuss about the distinction, because

regressions and ANOVAs are all linear models anyway. But you may

see the term “analysis of covariance”, so it’s worth your while

to know what it’s about.

\(\blacksquare\)

- Fit an analysis of covariance model to predict post-treatment score. Include an interaction between your explanatory variables. (You don’t need to look at the output from the model.)

Solution

This is what you’d guess. lm handles the interaction

properly, even though pre is a quantitative variable.

lepro.1 <- lm(post ~ pre * drug, data = lepro)I wanted to take a look, so I did:

summary(lepro.1)##

## Call:

## lm(formula = post ~ pre * drug, data = lepro)

##

## Residuals:

## Min 1Q Median 3Q Max

## -6.225 -2.437 -0.586 1.126 8.775

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) -1.6306 2.9455 -0.554 0.5850

## pre 0.7452 0.2849 2.616 0.0152 *

## drugD -2.9549 4.1246 -0.716 0.4806

## drugF -1.4780 5.4678 -0.270 0.7892

## pre:drugD 0.3233 0.3846 0.841 0.4089

## pre:drugF 0.4492 0.4458 1.008 0.3236

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 4.07 on 24 degrees of freedom

## Multiple R-squared: 0.6915, Adjusted R-squared: 0.6272

## F-statistic: 10.76 on 5 and 24 DF, p-value: 1.63e-05For testing the interaction, there are two slope coefficients

that should be zero if there is no interaction. So we have to test

this with drop1, which is next.

\(\blacksquare\)

- Pass your fitted model of the last part into

drop1. Is the interaction term significant?

Solution

Just this:

drop1(lepro.1, test = "F")## Single term deletions

##

## Model:

## post ~ pre * drug

## Df Sum of Sq RSS AIC F value Pr(>F)

## <none> 397.56 89.524

## pre:drug 2 19.645 417.20 86.971 0.593 0.5606There is only a test for the interaction term because you can’t take out the main effects until you’ve taken out the interaction.

The P-value for the interaction is very large (0.5606) so it is nowhere near significant. We can drop the interaction.

\(\blacksquare\)

- Fit a model without the interaction. Is this a sensible thing to do (in addition, that is, to the fact that I just asked you to do it)?

Solution

Change the * to a +:

lepro.2 <- lm(post ~ pre + drug, data = lepro)Or use update (not much in it, here):

lepro.2a <- update(lepro.1, . ~ . - pre:drug)We just said that the interaction could come out, since it wasn’t significant, so this is exactly the model that we should be fitting.

\(\blacksquare\)

- Take a look at the

summaryof your preferred model. Is there a significant effect of pre-treatment score? Describe the effects of the different drugs on the post-treatment score. (Don’t do any tests fordrug.) Does your comparison of drugs make sense?

Solution

Mine was the no-interaction model lepro.2:

summary(lepro.2)##

## Call:

## lm(formula = post ~ pre + drug, data = lepro)

##

## Residuals:

## Min 1Q Median 3Q Max

## -6.4115 -2.3891 -0.5711 1.7237 8.5885

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) -3.8808 1.9862 -1.954 0.0616 .

## pre 0.9872 0.1645 6.001 2.45e-06 ***

## drugD 0.1090 1.7951 0.061 0.9521

## drugF 3.4461 1.8868 1.826 0.0793 .

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 4.006 on 26 degrees of freedom

## Multiple R-squared: 0.6763, Adjusted R-squared: 0.6389

## F-statistic: 18.1 on 3 and 26 DF, p-value: 1.501e-06The pre-treatment term is definitely significant, with a P-value of 0.0000025. So pre-treatment score definitely has an impact on post-treatment score.

I didn’t ask you to test for significance of drugs. I just wanted you to assess their coefficients. Drug A is being used as the baseline, so its coefficient is zero. Drug D has a slightly positive coefficient (0.109) so its average bacilli score is slightly higher (for any pre-treatment score) than for drug A. Drug F, which was the placebo, has a slope of 3.446, so its average bacilli score is a fair bit higher than for either of the other drugs. This makes sense because a higher score is worse, and the two “real” drugs are both better than the fake one.

Whether there is a real drug difference, I didn’t ask you to assess,

but you could do it by drop1 again, this way:

drop1(lepro.2, test = "F")## Single term deletions

##

## Model:

## post ~ pre + drug

## Df Sum of Sq RSS AIC F value Pr(>F)

## <none> 417.20 86.971

## pre 1 577.90 995.10 111.049 36.0145 2.454e-06 ***

## drug 2 68.55 485.76 87.535 2.1361 0.1384

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1This is actually not significant.37

This is one of those cases where the non-significant drug has

a slightly bigger AIC than <none>, so drop1

considers it best to leave it in the model.

\(\blacksquare\)

- Obtain predicted values for

postfor each of the three drugs atprescores 5, 12 and 20. To do this, obtain a new data frame that has all 9 combinations of drugs andprescores, and then feed this intopredictusing your preferred model.38

Solution

First, make the new data frame for predicting from, using

crossing. I’m doing this in small steps for clarity:

first, I define all the drugs and pre values, and then I

feed them into datagrid:

drugs <- c("A", "D", "F")

pres <- c(5, 12, 20)

new <- datagrid(model = lepro.2, drug = drugs, pre = pres)

new## drug pre

## 1: A 5

## 2: A 12

## 3: A 20

## 4: D 5

## 5: D 12

## 6: D 20

## 7: F 5

## 8: F 12

## 9: F 20Now I obtain the predictions, from my best model lepro.2. I

don’t need intervals or anything like that:

preds <- predictions(lepro.2, newdata = new)

preds## rowid type predicted std.error conf.low conf.high drug pre

## 1 1 response 1.055110 1.450846 -1.927147 4.037367 A 5

## 2 2 response 7.965396 1.342345 5.206168 10.724625 A 12

## 3 3 response 15.862867 2.168562 11.405323 20.320410 A 20

## 4 4 response 1.164081 1.510335 -1.940457 4.268619 D 5

## 5 5 response 8.074368 1.308764 5.384165 10.764571 D 12

## 6 6 response 15.971838 2.076191 11.704166 20.239510 D 20

## 7 7 response 4.501248 1.814774 0.770926 8.231570 F 5

## 8 8 response 11.411535 1.275360 8.789994 14.033075 F 12

## 9 9 response 19.309005 1.722989 15.767350 22.850660 F 20I gave this a name in case I feel like using it again later.

\(\blacksquare\)

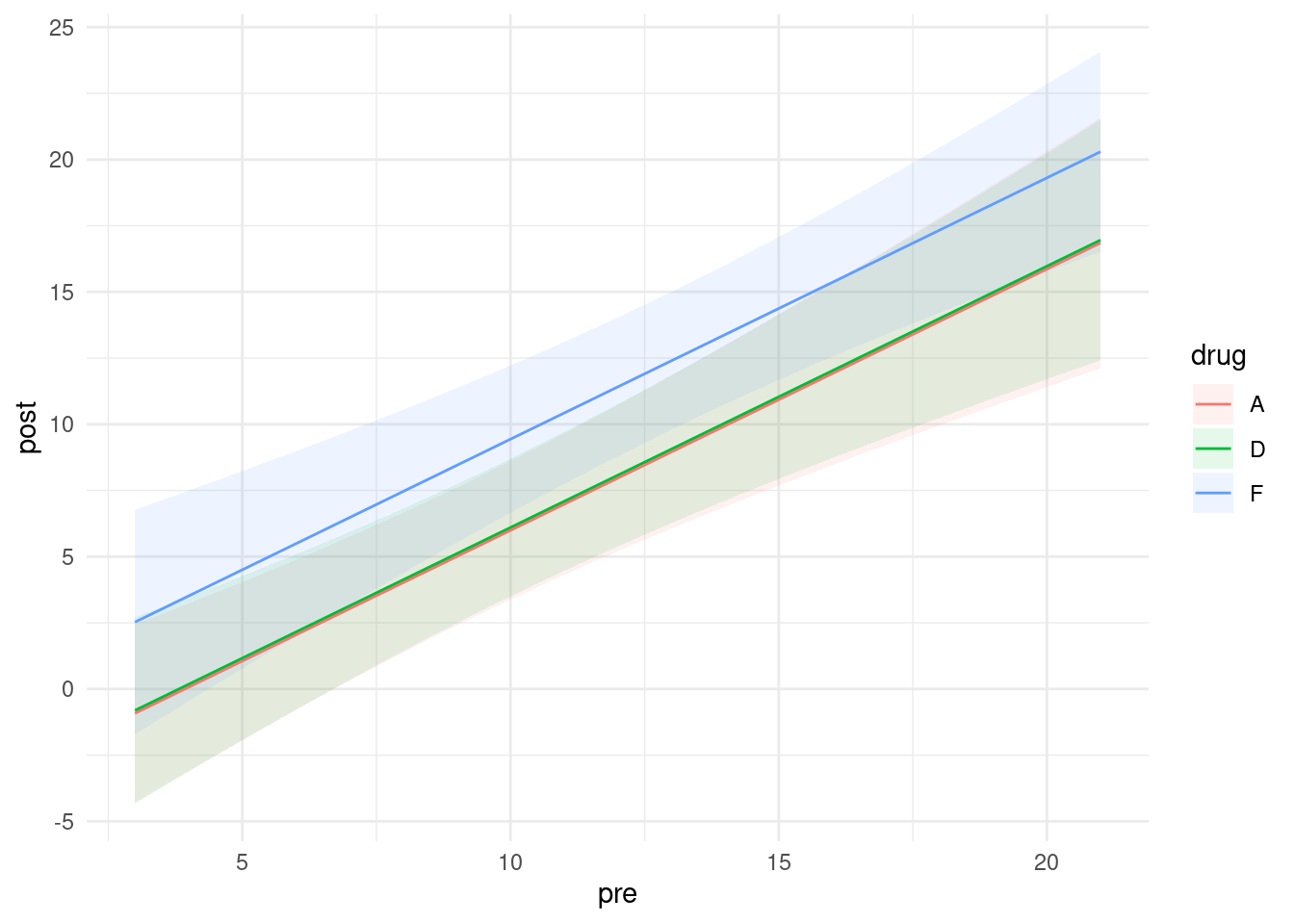

- Now, plot the data with the fitted lines on.

Solution

The starting point is to plot the predictions, which is plot_cap:

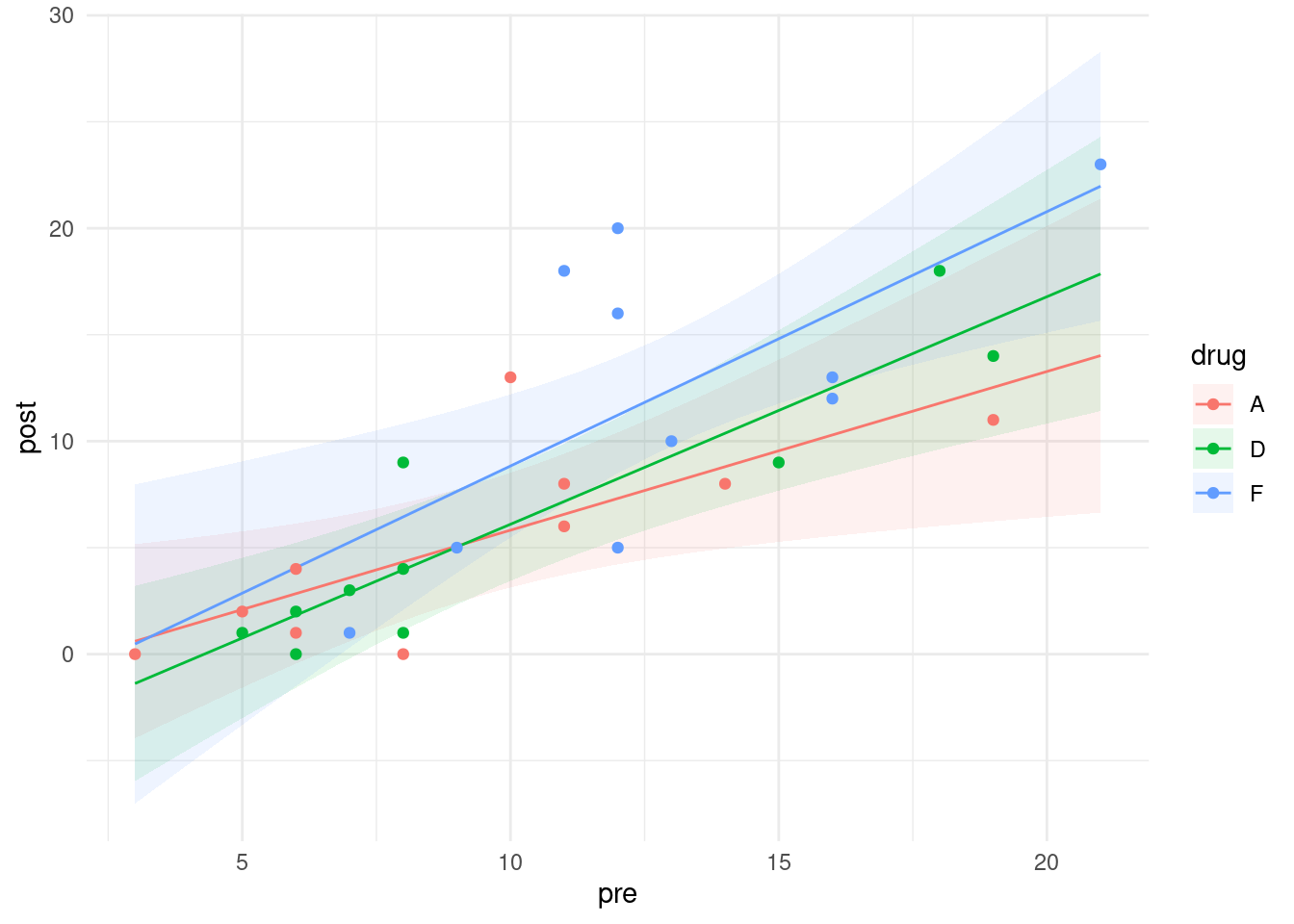

plot_cap(lepro.2, condition = c("pre", "drug"))

The olive-coloured line is actually the red and green lines right next to each other. You can check from the previous part that the predictions for drugs A and D are very close together, with those for drug F (the placebo) being higher (worse).

This is a ggplot, so we can add things to it. The idea is to say that the next thing to plot comes from some other dataframe, and to specify everything we need (that is, not to inherit from the original ggplot that is lurking within plot_cap):

plot_cap(lepro.2, condition = c("pre", "drug")) +

geom_point(data = lepro, aes(x = pre, y = post, colour = drug), inherit.aes = FALSE)

There is quite a lot of variability (which is why those confidence bands are so wide), but at least some of the blue points from drug F are above the others (worse), and there is very little to choose between drugs A and D.

\(\blacksquare\)

- Are the lines on your plot parallel, with the same slopes? Is this what you would expect? Explain briefly.

Solution

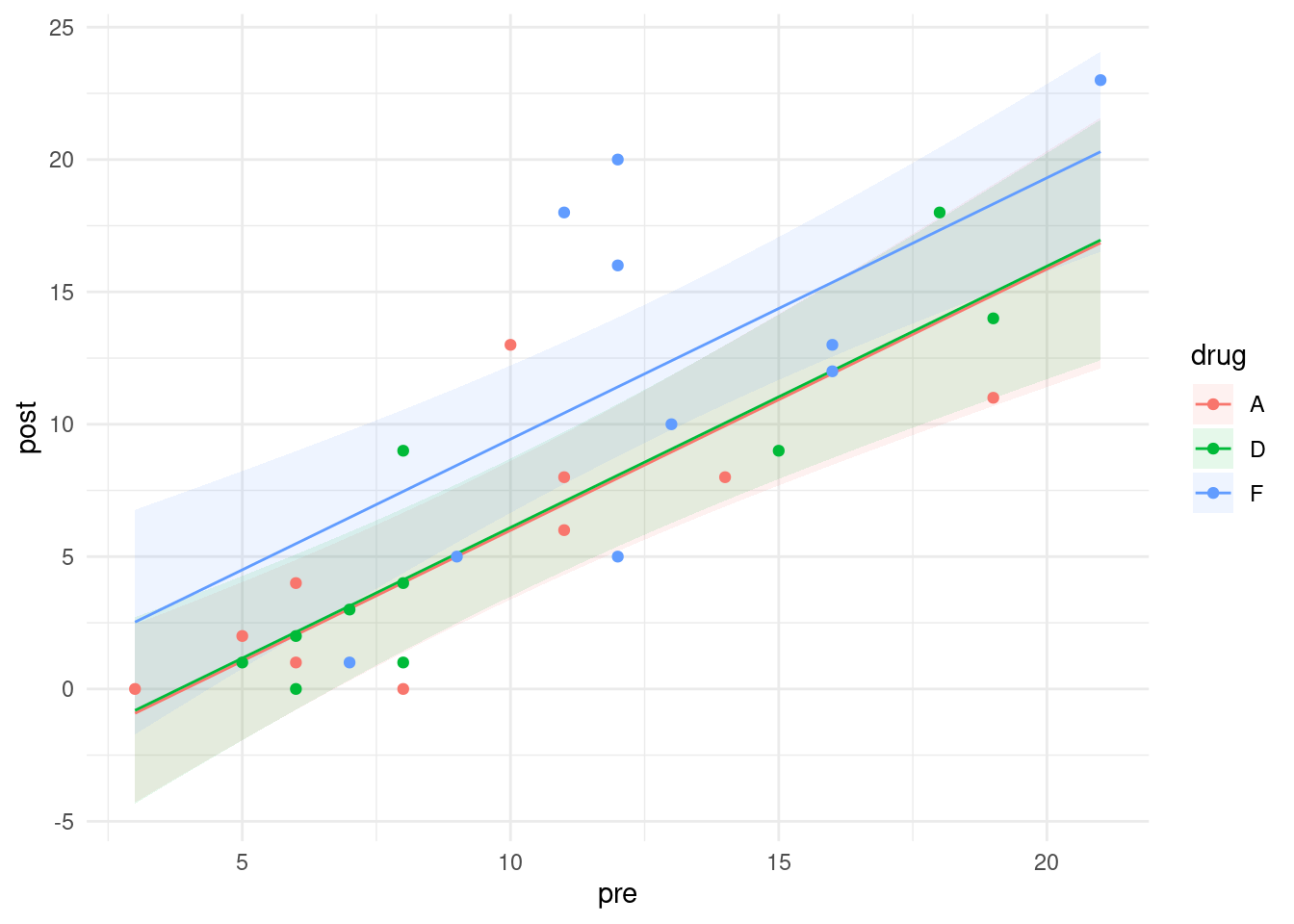

My lines are parallel. This is exactly what I would expect, since my best model has no interaction, and the interaction is what would make the lines not be parallel. If your best model did have the interaction term still in it, your predictions would have been these:

plot_cap(lepro.1, condition = c("pre", "drug")) +

geom_point(data = lepro, aes(x = pre, y = post, colour = drug), inherit.aes = FALSE)

There is, as you see, a substantial scatter in the points that would make it very difficult to prove that those three slopes are really different, even though the lines cross.

\(\blacksquare\)